Letter to Clients: 3rd Quarter 2021

July 2021

Dear Clients and Friends:

Introductions are in order. Linda Moore joined us at DV Financial in May. She and her husband live in Urbandale along with their dog, MoJo. When she is not working, Linda enjoys gardening, crafting, reading in her spare time and spending time with friends and family. Please join us in welcoming Linda to DV Financial team!

When Linda is introduced, we are frequently asked about LeKisha. Not to worry! She is still part of our organization but has moved into a new role. She has joined our Operations team focusing on compliance. So do not be surprised if she occasionally answers the phone or you see her when you come to the office.

While we have nothing official to announce yet, we are working on finding a new office. We moved from Windsor Heights to Urbandale nearly eight years ago and DV Financial has grown and changed quite a bit since then. We now have 5 people working in our office and frankly we are “busting at the seams”. We have something in the works, but until everything is finalized, we would prefer to just let you know that when we have news to share, you will be among the first to know.

By the time you read this, the Tokyo Olympics will hopefully be in progress after a being delayed by the global COVID pandemic, but the days and weeks leading up to the Games illustrates the uncertainly which permeates every aspect of 2021, including concerns many people have regarding their financial plan and investments.

We have said it before, and it is worth saying again; no one can consistently and accurately predict the future. However, we believe the best approach is to accept that unanticipated events are inevitable when constructing a financial plan and that rational unbiased analysis of the economy is the best way to determine if the plan can withstand current events or if adjustments are prudent.

While we often use this commentary to provide general financial education, this quarter we want to focus on how the market has performed, and our current perspective and analysis for the future.

Market Update

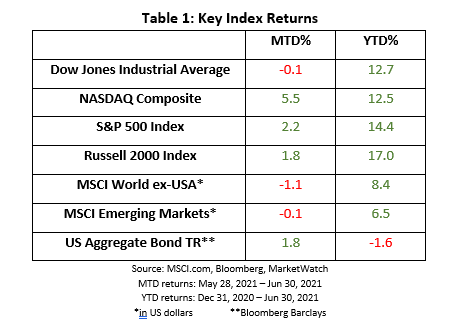

Investors with a principled approach to investing who adhered to a long-term investment plan reaped gains in 2020 and have continued to be rewarded in 2021. As the first half of the year ended, the S&P 500 Index, which is a broad-based index of 500 of the largest U.S. companies, ended June at a record high. The more often referenced Dow Jones Industrial index, which is made up of just 30 large firms, also finished the first half with a strong gain of nearly 13%. Meanwhile, the Russell 2000 Index, composed of two thousand smaller companies, is also up an impressive 17% for the first six months of the year.

Bull markets that have emerged after a decline of at least 30% typically have strong returns for the first year following the decline[1]. The 75% rebound which followed 2020’s 34% decline is no exception and was most profitable first year of the six bull markets which followed a 30% or greater decline since World War II. The 2009 rally following the Great Recession was the second most profitable first year at 69%. The average of these six bull markets is 41% in the first year following the decline. Not only is that an impressive one-year average, but it serves as a lesson to stay invested during seemingly bad times because the reversal is typically swift and unexpected. Investors who “flee to safety” by selling to cash during a market downturn can find themselves chasing returns when the markets reverse.

In the second year after a major decline, strong returns do typically continue with an average S&P 500 return of 17%, but not without some volatility. The second year of these bull markets typically include intra-year declines averaging 10%. So far, we have not had a meaningful pull back in broad market indexes during the second year of our current rally, but we are only a few months into the second year.

Every cycle is unique and has its own peculiarities, yet there are also common themes from which we can infer. Returns are typically driven by momentum, expanding expansion, corporate profits, and monetary policy all of which look good now, but are we on a post-COVID “sugar high” of pent-up demand paired with financial stimulus?

Economic Engine Diagnostics

As much as history is a tool from which to learn, there is no historic precedent for our current situation. The economy has never been locked down and then reopened. This is uncharted economic territory, the complexity of which is almost incomprehensible.

The 1958 essay, “I, Pencil.”, written by Leonard Reed simply and eloquently demonstrates the complexity of our economy. Although it is 63 years old, its validity remains and is worth examining.

"I am a lead pencil – the ordinary wooden pencil familiar to all boys and girls and adults who can read and write… I am seemingly so simple… Yet, not a single person on the face of this earth knows how to make me."

This excerpt from the opening paragraphs summarizes the gist of the essay. You have the simplest of products – a yellow number 2 lead pencil – but think about how many people are involved in its creation. How many people are employed in the lumber industry which provides the wood for the pencil? Now consider the rubber industry which makes the eraser tip, and the metal industry which secures the eraser to the wood. How about the lead itself? I honestly have no idea where that comes from. Another industry creates the packaging to sell the pencils. The trucking industry probably transports the product from the manufacturer to the wholesaler, and eventually to the retailer. How did you know where to buy a pencil? Perhaps from marketing or advertising?

How many people need to be employed just for you to have a pencil?

This simple example just illustrates the complexity of our modern economy. Now consider a much more complex product such as a computer or an automobile, not to mention billionaires racing into space.

Everybody know somebody who has a story to tell right now about a product or service they can’t get because it is delayed because of a supply chain issue. Many of those issues are seeming unrelated, but they are not. It would be interesting to follow the chain. Such as I can’t get paint from the home improvement store because manufacturer can’t get aluminum paint cans because the aluminum is in a freight container at sea which can’t be unloaded because there is not a worker to unload the cargo ship because the worker has to stay at home to watch their children because the babysitter is unavailable because they got offered a huge bonus to work at Starbucks who was having trouble finding workers…

While that was a fun chain of unrelated events to string together, and it is entirely fictitious, it only begins to describe the interconnectedness of our economy.

Stopping the economy was simple enough; restarting it is proving harder than anyone anticipated. Frankly, I admit it has gone better than I would have thought. My analogy is like air bubbles in an engine’s fuel line. Until all the air bubbles work their way out of the system, there will be a chance any one of the air bubbles can stall the engine or, at very least, cause the engine to run rough for a moment.

Thankfully, the American economy is strong because it is built on a foundation of innovation and free markets. Our long term expectation is good, but we do recognize that there will be occasions when the “air bubbles” make the engine run rough. It may take years for our complex economy to achieve equilibrium and balance again.

Should you worry about inflation?

Inflation is also worthy of watching. To some degree, inflation is necessary. Without inflation, procrastinating expenditures becomes a viable financial strategy. Yet too much inflation is counterproductive too. If wages can’t grow enough to keep place with the rising costs of goods and services, people lose their incentive to work which leads to unemployment and supply chain issues.

Like the complexity of the supply chain, inflation must be in balance. The Fed has set an inflation target of 2%, but how do they control inflation?

My favorite way to illustrate inflation is to consider a limited economy which is comprised of $10 and 10 apples. If there was nothing else in the economy, the value of each apple is easy to determine. If we divide the supply of money ($10) by the number of apples, it is easy to determine that each apple is worth $1.

What happens if the government decides to do economic stimulus and supply of money increases to $14? If the number of apples remains at 10, then each apple is worth $1.40. But suppose the farmer can’t deliver 10 apples, or some of them rot. Suppose now there are only 7 apples. We divide the $14 money supply by the 7 available apples, and we determine that each apple is worth $2 (100% inflation).

That is a gross oversimplification of the issues facing the economy today. The complexity and interdependence of everything makes it difficult to adjust anything without disrupting the careful balance. Yet that is exactly what we have done. The economic shutdown paired with the increased money supply is a recipe for inflation.

Which brings us full circle from where this letter started. When we build financial plans, we don’t plan on perfect weather every day. We know that even the best weather locations occasionally have (and need) rainy days. Much like the weather, we don’t know exactly when the storms will come or how long they will last, but we do build our financial plans knowing that they need to be able to weather the storms ahead.

We are grateful and honored to be your trusted advisors. If you (or anyone you know) have concerns or questions about your plan and its ability to withstand the storms, please give us a call. Together we can review your situation and adjust if necessary. Thank you for the trust you have placed in us. It is a responsibility we do not take lightly.

Sincerely on behalf of the DV Financial team,

Art Dinkin, CFP® Patrick Owens

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

The Six Month 95% Probability Range is calculated by Riskalyze from the standard deviation of the portfolio (via covariance matrix), and represents a hypothetical statistical probability, but there is no guarantee any investments would perform within the range. There is a 5% probability of greater losses. The underlying data is updated regularly, and the results may vary with each use and over time.

IMPORTANT: The projections or other information generated by Riskalyze regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. These figures may exclude commissions, sales charges or fees which, if included would have had a negative effect on the annual returns. Investing is subject to risk and loss of principal. There is no assurance or certainty that any investment strategy will be successful in meeting its objectives. Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices do not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.

[1] LPL Research - https://www.lpl.com/news-media/research-insights/weekly-market-commentary/look-back-bull-bear-market.html