Letter to Clients - 1st Quarter 2025

January 2025

Dear Clients and Friends:

Happy New Year! We certainly hope your holiday season was filled with joy and wish this upcoming year will be even better.

The past year was one of transition for DV Financial. In late 2023 the planned transition from TD Ameritrade to Charles Schwab began and in 2024 we transitioned our Broker Dealer relationship to Emerson Equity. As the year progressed, we also responded to regulatory reporting changes regarding voting proxies for clients. After many years of providing this service we made the difficult decision to no longer offer proxy voting on behalf of clients. Putting this policy change into effect meant another round of forms for every account at Schwab.

Now in our sixth quarter of working with Charles Schwab, we are reassessing the relationship. Schwab is one of the oldest and most established investment custodial firms in the business. The challenge for us has been learning their processes and procedures. Let’s just say that sometimes they have a way of making simple tasks unnecessarily complicated. While there is nothing inherently wrong with Schwab, we have been looking at other custodians for a better solution.

To a degree, all custodians perform the same function. They are an independent party which holds custody of the investments in your account, and they perform independent reporting directly to you, the client.

In mid to late 2023, we were introduced to Altruist which is a new and rapidly growing custodian. They pride themselves on their use of technology. Their advantage was building a new custodial platform without the burden of having legacy manual processes to consider and the result is nothing short of spectacular. Their web-based interface is simple, clean, and efficient. Processes which are manual at Schwab are automated at Altruist which eliminates a lot of the difficulty and frustrations we have dealt with at Schwab.

That said, Altruist may not be the best solution for everyone, and we are not abandoning our relationship with Charles Schwab. During the first quarter of 2025 I will be reaching out to everyone to discuss if transitioning your accounts from Schwab to Altruist makes sense for you. If this is something you want to discuss sooner, please give us a call.

2024 – Year in Review

In our January 2024 client letter, we wrote “The only prediction we believe for 2024 would be to expect the unexpected.” In retrospect, 2024 was certainly unexpected. A year ago, we were quite concerned about inflation and were less than confident that the Fed could orchestrate a soft landing. Our commentary included “We will be watching inflation and interest rates carefully.”

Early in the year, the Fed signaled interest rate cuts, not due to fears of economic recession, but because they anticipated a slowdown in the rate of inflation. Prices are still elevated today, and inflation continues to exceed the Federal Reserve’s annual target of 2%. However, the inflation rate did ease during the year which encouraged the Fed to take action in September. This led to three consecutive reductions in interest rates and by the end of the year the Fed had lowered rates by a full percentage point to 4.25% - 4.50%.

This easier economic monetary policy combined with economic growth and rising corporate profits fueled the second consecutive annual gain of over 20% in the S&P 500 index. This is the first back-to-back 20%+ increase since a four-year stretch that ended in 1998![1] The surge in mega-cap technology stocks were significant contributors to the rise in the large cap stock indexes in 2024. According to Barron’s and Dow Jones Market Data, the seven largest technology firms known as the Magnificent 7 made up over half the gains in the S&P 500 Index, a carryover trend from 2023’s performance.

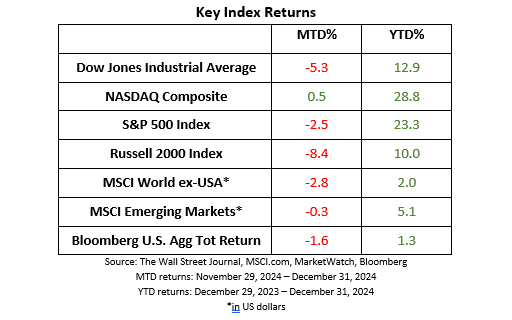

Note the significant difference in the performance of the Dow Jones Industrial Average versus the tech heavy NASDAQ and the S&P 500. The Dow posted gains of nearly 13% which, by all measurements, is a good year. However, it was significantly less than the S&P 500 and NASDAQ which nearly doubled the return of the Dow. This discrepancy can be attributed to the differing methodologies used to create and calculate these indexes.

Annual returns also minimize the volatility throughout the year. December, by most measurements, was not a good month. Although volatility can be unsettling, it is often temporary. In 2024 the maximum peak to trough pullback for the S&P 500 was just under 9%[2] and was inspired by a shift in monetary policy by the Bank of Japan. However, investors quickly shifted their focus back to the U.S. economic fundamentals and stock indexes soon reached new highs.

Looking Ahead for 2025

Many of the major themes which drove the market in 2024 remain in place for 2025. The economy is expanding, corporate profits are expected to remain on an upward trajectory, and while the Fed is anticipating fewer rate cuts this year it isn’t currently considering rate hikes. The incoming Trump administration is expected to promote deregulation which should benefit both corporate profits and economic growth. With a Republican controlled House, Senate, and White House we may see a reduction in the corporate tax rate fueling additional stock buybacks to underpin stock performance.

Yet there are potential problems which may stymie investors in 2025. For example, a rebound in inflation could force the Fed to raise interest rates. If the Fed misjudges the economy and either over-reacts or fails to respond accordingly, a deteriorating economic outlook could quickly hamper corporate profits. For example, President Trump’s sweeping tariffs rhetoric, if enacted, could instigate a bump in inflation accompanied by slower economic growth. All of these potential issues could lead to market uncertainty and increased volatility.

We believe longer term Treasury yields will be a pivotal issue this year. Despite multiple Fed rate cuts last year, longer term Treasury yields rose significantly towards the end of last year amid slower progress on inflation, upbeat economic growth, and a stubbornly high federal deficit. If these long-term rates continue to rise, this can pose a challenge for equities as investors may shift away from stocks towards the stability of higher yield treasuries.

This is why we believe that a properly diversified portfolio, consistently invested, continues to be the best strategy for investors. While no strategy can completely shelter you from market pullbacks, our approach can lower overall volatility and has historically been the most effective path to achieving your financial goals. Our process is guided not only by our experience, but also supported by academic research. We recognize that all asset classes are subject to periods of subpar returns, but patient and discipline investors have historically been rewarded.

2025 Tax Adjustments

Many parts of the tax code are “inflation adjusted” which means that some things change automatically based on changes in the cost of living. The Internal Revenue Service has published the revised adjustments for tax year 2025, which will affect taxes due in April 2026.

While there are more than 60 provisions which have been adjusted or changed[3], the most notable changes are summarized below:

-

Marginal Brackets have changed, but the tax rates remain the same.

-

37% for incomes over $626,350 ($751,600 for married couples filing jointly)

-

35% for incomes over $250,525 ($501,050 for married couples filing jointly)

-

32% for incomes over $197,300 ($394,600 for married couples filing jointly)

-

24% for incomes over $103,350 ($206,700 for married couples filing jointly)

-

22% for incomes over $48,475 ($96,950 for married couples filing jointly)

-

12% for incomes over $11,925 ($23,850 for married couples filing jointly)

-

10% for incomes $11,925 or less ($23,850 or less for married couples filing jointly)

-

-

Standard Deductions. For single taxpayers and married individuals filing separately, the standard deduction rises to $15,000, an increase of $400 from tax year 2024. For married couples filing jointly, the standard deduction rises to $30,000, an increase of $800 from tax year 2024. For heads of households, the standard deduction will be $22,500, an increase of $600 from tax year 2024.

-

Employer Sponsored Retirement plan limits. Participants in 401(k) and 403(b) plans may now contribute up to $23,500 (up from $23,000 in 2024) and the catch-up provision for these plans for participants age 50+ also increased to $7,500 (up from $7000 in 2024). Self employed individuals who have a SEP-IRA are still limited to 25% of their employee compensation, but the contribution cap has increased from $69,000 to $70,000.

-

Alternative minimum tax exemption amounts. For tax year 2025, the exemption amount for unmarried individuals increases to $88,100 ($68,650 for married individuals filing separately) and begins to phase out at $626,350. For married couples filing jointly, the exemption amount increases to $137,000 and begins to phase out at $1,252,700.

-

Earned income tax credits. For qualifying taxpayers who have three or more qualifying children, the tax year 2025 maximum Earned Income Tax Credit amount is $8,046, an increase from $7,830 for tax year 2024. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

-

Qualified transportation fringe benefit. For tax year 2025, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking rises to $325, increasing from $315 in tax year 2024.

-

Health flexible spending cafeteria plans. For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements rises to $3,300, increasing from $3,200 in tax year 2024. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount rises to $660, increasing from $640 in tax year 2024.

-

Medical savings accounts. For tax year 2025, participants who have self-only coverage the plan must have an annual deductible that is not less than $2,850 (a $50 increase from the previous tax year), but not more than $4,300 (an increase of $150 from the previous tax year).

The maximum out-of-pocket expense amount rises to $5,700, increasing from $5,550 in tax year 2024.

For family coverage in tax year 2025, the annual deductible is not less than $5,700, increasing from $5,550 in tax year 2024; however, the deductible cannot be more than $8,550, an increase of $200 versus the limit for tax year 2024. For family coverage, the out-of-pocket expense limit is $10,500 for tax year 2025, rising from $10,200 in tax year 2024.

-

Foreign earned income exclusion. For tax year 2025, the foreign earned income exclusion increases to $130,000, from $126,500 in tax year 2024.

-

Estate tax credits. Estates of decedents who die during 2025 have a basic exclusion amount of $13,990,000, increased from $13,610,000 for estates of decedents who died in 2024.

-

Annual exclusion for gifts increases to $19,000 for calendar year 2025, rising from $18,000 for calendar year 2024.

-

Adoption credits. For tax year 2025, the maximum credit allowed for the adoption of a child with special needs is the amount of qualified adoption expenses up to $17,280, increased from $16,810 for tax year 2024.

However, a few notable items that were indexed for inflation in the past, were not adjusted in 2025:

-

IRA Contribution Limits. IRA contribution limits for 2025 remain at $7000 for those under age 50 and $8000 for those age 50 and older.

-

Personal exemptions for tax year 2025 remain at $0, as in tax year 2024. The elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act of 2017.

-

Itemized deductions. There is no limitation on itemized deductions for tax year 2025, as in tax year 2024 and preceding, to tax year 2018. The limitation on itemized deductions was eliminated by the Tax Cuts and Jobs Act of 2017. However, unless itemized deductions exceed the standard deduction (see above) the need to itemize deductions has been eliminated for many tax filers.

-

Lifetime learning credits. The modified adjusted gross income amount used by taxpayers to determine the reduction in the Lifetime Learning Credit provided in Sec. 25A(d)(1) of the Internal Revenue Code is not adjusted for inflation for taxable years beginning after Dec. 31, 2020. The Lifetime Learning Credit is phased out for taxpayers with modified adjusted gross income in excess of $80,000 ($160,000 for joint returns).

Looking ahead, no one knows exactly what to expect tax-wise after 2025. The Tax Cuts and Jobs Act (TCJA) was passed under President Trump’s first term in 2017 and went into effect for tax year 2018. But many of the provisions of the TCJA are scheduled to expire at the end of 2025. Republicans generally favor a broad extension of the TCJA, however it is uncertain how negotiations will eventually play out.

If the TCJA is allowed to sunset, here are some of the changes you might expect:

-

Marginal tax rates for individuals will revert to pre-TCJA levels which have a top rate of 39.6% instead of 37%.

-

The standard deduction will return to pre-TCJA levels with an adjustment for inflation. For single filers, the standard deduction would be approximately $8300 and $16,600 for married filers.

-

The child tax credit will be reduced to $1000 from $2000.

-

The personal exemption would be reinstated and valued at about $5300 [4].

-

The gift and estate tax exemption would be reduced from $13.99 million to roughly $7.5 million[5].

-

The $10,000 cap on itemized state and local taxes (SALT) would be removed.

-

The 20% tax deduction for pass-through businesses will disappear.

Without a doubt, the tax code is complex. While we are not tax advisors, we are able to work closely with your tax advisor so that you can approach taxes strategically and we can use your tax plan as a factor in your overall financial plan and investment strategies.

Get Comfortable

As always, we are honored to serve as your financial advisor. We appreciate the trust you have placed in us. We hope you have found this newsletter to be informative. If you wish to discuss anything from this newsletter or any other matter, please let us know so we can schedule time to address your concerns.

Sincerely,

Art Dinkin, CFP®

[2] St. Louis Federal Reserve

[3] https://www.irs.gov/pub/irs-drop/rp-24-40.pdf

[4] https://taxfoundation.org/blog/2026-tax-brackets-tax-cuts-and-jobs-act-expires/

[5] https://www.fidelity.com/learning-center/wealth-management-insights/TCJA-sunset-strategies