Letter to Clients: 4th Quarter 2021

October 2021

Dear Clients and Friends:

Greetings from the new DV Financial office! We made the move to our new facility on October 1st and are almost completely settled in. Like any move to a larger facility, it looks like we have some more furniture to buy.

A separate invitation will be coming out shortly, but we hope you can join us for an Open House on Thursday October 28th from 5:00 pm to 7:30 pm, come-and-go. With such proximity to Halloween, we thought it would be fun to have a Trick or Treat theme. Tricks will be provided by Mr. Magic, Jonathan May – Comedy Magician. Mr. Magic will be doing closeup magic and making balloon animals for the kids (of all ages). Of course, there will also be Treats: a nacho bar catered by Fuzzy’s Taco Shop and plenty of adult and family friendly beverages to quench your thirst. No need to RSVP, just come on by and say hello and see the new facility. We are now at 2350 NW 128th Street in Urbandale (northwest corner of Hickman & 128th St). Bonus points if you come in costume!

What is it about September?

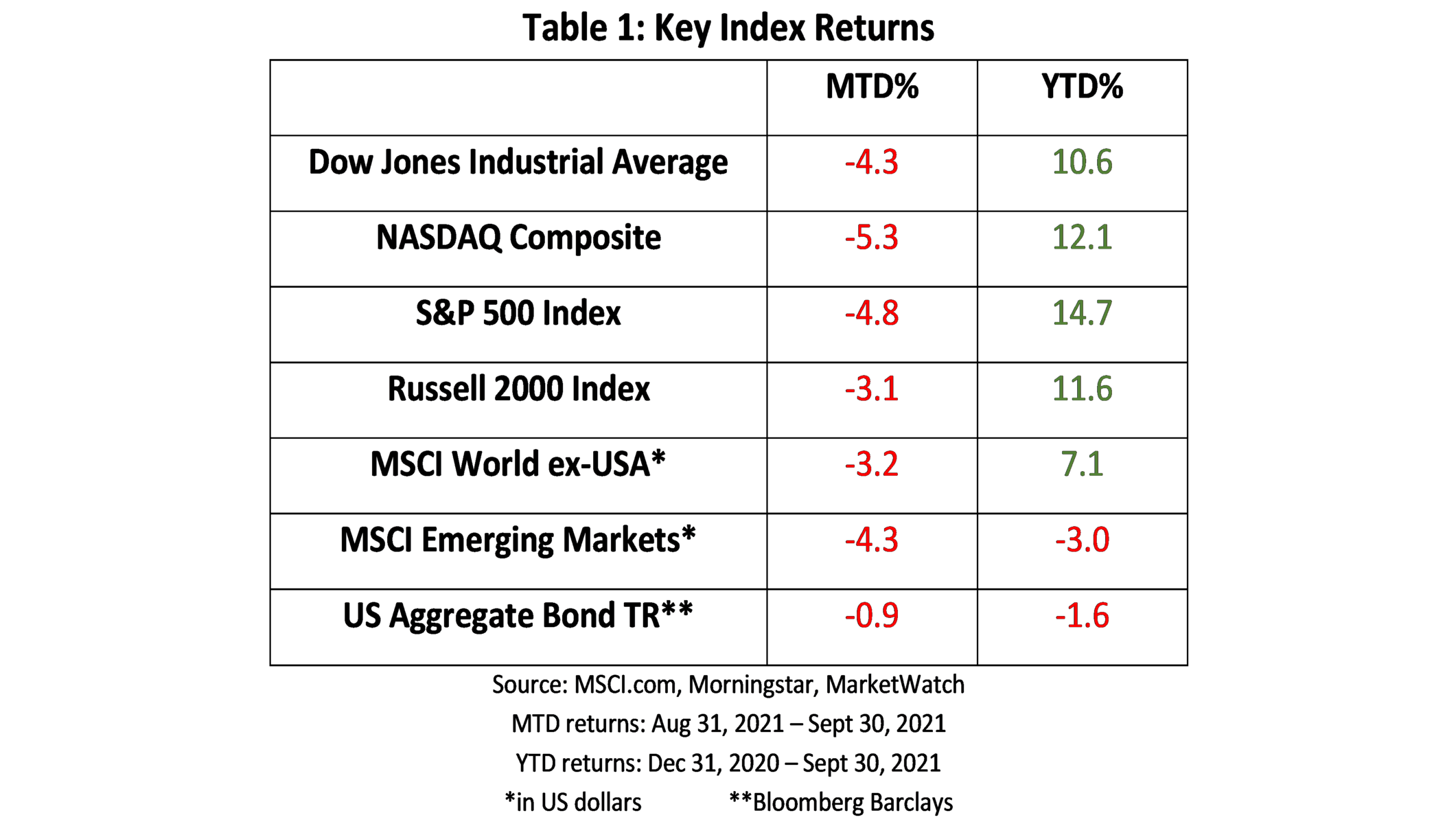

September has historically been one of the worst months for stocks and 2021 was no exception. After reaching a record peak on September 2, 2021, the S&P 500 Index fell 4.8% in September which was the first monthly decline since January 2021 and the worst decline since March 2020 when the COVID lockdown began.

A 4.8% drop is modest by market standards. In fact, we have yet to experience a 10% or greater “correction” since the bull market began in March 2020. While a multitude of analysts have offered a variety of explanations, no one can pinpoint concrete reasons why we often see seasonal weakness towards the end of summer. However, we do think two issues have a lot to do with this year’s weakness.

The first is the ongoing battle against COVID. Upticks in cases paired with concern of unvaccinated children returning to school has caused uncertainty which is never helpful to the markets.

Bank deposit data from the St. Louis Federal Reserve suggests consumers have higher than normal levels of discretionary cash, but with a reduction in new stimulus spending has slowed. We are also experiencing high inflation as the supply chain continues to disrupt economic balance. Together with a labor shortage, supply chain problems are crimping profitability, limiting sales, raising prices, and hampering economic growth. Investors are responding accordingly.

Add to that political unrest typically associated with the debt ceiling (which Congress effectively solved by postponing the problem until December) and proposed tax increases.

Are My Taxes Going Up?

The House of Representatives, under the direction of President Biden, are working to introduce changes to the tax code designed to increase taxes on the wealthy. These proposals are a long way from becoming law, but they are winding their way through Congress.

This summary is not intended to serve as advice. Every situation is unique and our goal here is to provide an educational overview. We would be happy to visit with you and answer any questions you may have and encourage you to also consult with your tax advisor.

Major provisions of the proposal include:

Raising the top federal income tax bracket from 37% to 39.6%,

Levying a 3% surtax on income higher than $5 million,

Raising the tax on dividends and long-term capital gains to 25% for high income earners,

Introducing new limits on large retirement account balances, and

Limiting QBI (Qualified Business Income) deductions for pass-through businesses.

Increase in the top tax rate. The top tax bracket (taxable income greater than $628,300 married filing jointly or $523,600 single) is proposed to rise from 37% to 39.6%. If this change is enacted, the 2.6% increase would cost high income taxpayers an additional $260 for each $10,000 they earn above the $628,300 or $523,600 threshold.

Surcharge on income over $5 million. This effectively creates a new top bracket for very high-income earners at 42.6%. While this would affect very few taxpayers, the sale of a small business is one situation which, if not properly structured, could trigger this surcharge. Also noteworthy is that this is separate and in addition to today’s 3.8% tax on net investment income.

Changes to Dividend & Capital Gains. As proposed, any capital gain realized after September 13, 2021, for couples earning over $450,000 (or individuals earning more than $400,000) will pay a top rate of 25%. The same would apply to dividends. Take note of the date in the proposal. If this passes without change, transactions effected today would already be taxed at the higher rate.

Limits on large retirement accounts. Like the thresholds for the changes in dividends and capital gains, couples earning over $450,000 (or individuals earning more than $400,000) who also have retirement accounts with $10 million or more will be subject to Required Minimum Distributions (RMDs) beginning in 2022. These RMDs serve dual purposes. First, it forces a reduction the retirement account assets and it also subjects the assets to tax. Of course, contributions to retirement accounts would be restricted while RMDs apply. Taxpayers who exceed the income threshold and who have retirement accounts in excess of $20 million (including Roth IRA’s) would have also have to make distributions from their Roth IRAs. Note that none of these retirement account limits would apply to employer sponsored plans such as 401(k)s, SIMPLEs, or SEPs.

Qualified Business Income (QBI) deduction limits. For the self-employed who use a pass-through business structure, QBI would be limited to $500,000 for joint returns and $400,000 for individual returns. Deductions over the cap for business expenses would be disregarded.

While it is still probably too early to anticipate exactly what will be included in the final bill, it is prudent to consider if the proposed tax changes will be an issue for you and, if so, how much it will impact your tax liability. There are a few things you could do in anticipation. For example, instead of deferring income (a common tax deferral strategy), taxpayers may want to shift taxable income from 2022 to 2021 to take advantage of the current lower rate. Taxpayers who are still eligible can maximize contributions to retirements. Charitable contributions may also reduce taxable income for taxpayers who itemize their personal expenses. The taxable equivalent yield (TEY) of municipal bonds would increase for taxpayers who experience an increase in tax rates.

Even with all these changes, the President proposed several additional tax reforms which are not currently under consideration. For example, lawmakers in the House have not proposed taxing unrealized capital gains at death or removing the step-up in basis for inherited assets even though both had been mentioned by President Biden. One item which may potentially be included is a reduction in the estate and gift tax exclusion down to $5 million. Tax reform passed in 2017 had raised it to $11.7 million per individual or $23.4 million per couple.

The bottom line is we expect significant changes to the tax code to be addressed before the end of the year, although most of the reforms we expect won’t have significant impact on most taxpayers. Those changes together with the labor shortages, supply chain interruptions, and continued COVID uncertainty does dampen our short-term outlook. While a market correction of 10% or more is unpleasant, it is a normal part of the long-term investment process.

We remain committed to our core principle that we are investors and not traders. The long-term outlook has stood the test of time and we have no reason to believe the future will be different. We seek to capitalize through patience and discipline rather than guessing when to zig and when to zag.

If you have any questions or would like to discuss anything in this newsletter, please give our team a call. We are here for you. If you have concerns or want to discuss your situation, let us know. We are honored and humbled to serve as your financial advisors.

Don’t forget to stop by and see our new office on October 28th!

Sincerely on behalf of the DV Financial team,

Art Dinkin, CFP® Patrick Owens

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices do not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.