Letter to Clients - 1st Quarter 2023

January 2023

Dear Clients and Friends:

On behalf of the entire DV Financial team we want to wish you Happy New Year and hope you had a wonderful holiday season. Even though the new year is nothing more than an arbitrary advancement of the calendar, it is an opportunity for a fresh start. After the market challenges of 2022 we are certainly hopeful that 2023 provides better returns, but more on that in just a moment.

First, we want to introduce a new member of our team. Ihla Oertwig joined DV Financial at the end of October as our new Office & Administrative Manager after retiring from over 30 years of service with the State of Iowa. She and her husband, Ord, are long time Des Moines area residents who live at home with their cat, Bolt. She has a son who is also a Des Moines resident and a stepdaughter in the Navy and currently stationed in San Diego, CA. Please be sure to say “hello” to her if you hear a new voice on the phone.

2022 In Review

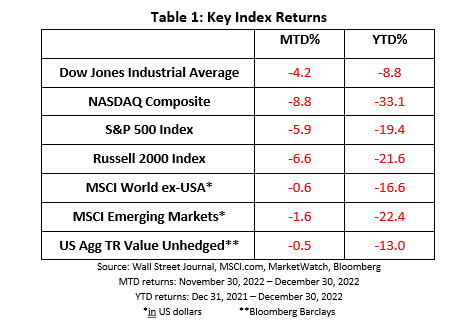

2022 was an unpleasant year for investors. The Dow Jones Industrial Average (DJIA) and the broader-based S&P 500 peaked early in the year1 and then began a decline. By the time Russia invaded Ukraine in late February, market indexes were already down around 10%. The invasion compounded market woes and exacerbated inflation by temporarily sending oil prices much higher and lifting commodities such as wheat. Stubbornly high inflation prompted the Fed to execute the fastest series of rate hikes since 19802.

The favorable economic fundamentals we were treated to in the 2010s—low interest rates, low inflation, and modest economic growth shifted dramatically last year. Even though the economy continued to expand, interest rates and the inflationary environment overwhelmed tailwinds from economic and profit growth.

Six months ago, in this letter we pointed out that downturns are a natural market cycle but what made 2022 unusual and particularly painful was positive correlation. We quantify the relationship between different investments with a measurement known as correlation. When two investments are negatively correlated, they move in opposite directions; when one goes up the other goes down. When investments move in the same direction, we say they are positively correlated. 2022 was one of only 3 years since 1950 that stocks and bonds were positively correlated while both had negative returns3. All securities became positively correlated in 2022.

Even though everything was correlated, the returns on major market averages varied widely. The Dow “only” lost 8.8% while the S&P 500 Index gave up 19.4%. According to CNBC, this was biggest disparity in over 60 years. Despite the wide disparity last year, over time index performance tends to correlate more closely.

Despite these correlations, we are not interpreting this data as the death of diversification. While such broad correlations are rare, it has happened before. As it has in the past, we believe this too shall pass. In his 2021 annual shareholder letter Warren Buffet wrote, “In its brief 232 years of existence … there has been no incubator for unleashing human potential like America”. He continued, “Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

We continue, unwavering, to agree.

Inflation and the Economy Ahead

Inflation is the root of the problem. A year ago, the Fed belatedly recognized that 2021’s surging inflation wasn’t simply “transitory,” its word of choice at the time. Annual CPI was 7.0% in December 2021; it peaked at 9.1% in June 2022 and moderated to a still high 7.1% by November 2022, the last available reading.4 The recent slowdown in inflation is welcome but a couple of months of lower readings may not be indicating a trend, at least in the Fed’s opinion.

While the Fed appears set to slow the pace of rate interest increases in 2023, it has also signaled that peak inflation will last longer as it attempts to bring the demand for goods, services, and labor into alignment with the supply of goods, services, and labor. Their weapon of choice—higher interest rates—is a blunt instrument. It does not operate with precision and has painful effects.

However, this year could bring new challenges, and attention has slowly been shifting away from inflation to economic performance. The Conference Board’s5 Leading Economic Index is a closely watched index designed to anticipate a recession. It does not indicate when a recession may start, nor should it be used to forecast the impact of a recession. But the index has never failed to decline in front of a recession (with data back to 1960). Through November, it has fallen for nine-straight months. Moreover, more than two-thirds of economists at 23 large financial institutions expect the U.S. will slide into recession this year6.

Yet an upcoming recession is not a foregone conclusion. A resilient labor market and a sturdy consumer, with borrowing power and some pandemic cash still in the bank, could support economic growth this year. A 3.7% jobless rate, which is just below this 2022’s low of 3.5%, coupled with still-robust job growth, is sending a signal that the economy continues to expand.

Legislative Changes Effecting Retirement

The SECURE 2.0 Act is now law and provides many changes to the retirement system which recognize that Americans are living and working longer:

Required Minimum Distribution (RMD) Age Change. Three years ago, the original SECURE Act increased the age for taking RMDs from 70½ to 72. If you have already been subject to RMD’s, the new legislation does not affect you. But if you turn 72 this year, you may postpone your RMD until age 73 in 2024. Also in 2024, employees participating in a Roth 401(k) won’t be required to take RMDs from their Roth 401(k). Starting in 2033, the age for RMD’s will rise to age 75.

RMD Penalty Relief. The new legislation reduces the penalty for missing an RMD from 50% to 25%. It also provides a further reduction in the penalty to 10% if the RMD that was missed is taken in a timely manner and the IRA account holder files an updated tax return.

Automatic Enrollment & Portability. Starting in 2025, companies that set up new 401(k) or 403(b) plans will be required to automatically enroll employees at a rate between 3% and 10% of their salary. The new legislation also allows for automatic portability, which will encourage folks in low-balance plans to transfer their retirement account to a new employer-sponsored account rather than cash out. To encourage employees to sign up, employers may offer gift cards or small cash payments. However, none of this changes the employee’s option opt out of the employer-sponsored plan all together.

Matching for Roth Accounts. Employers will be able to provide employees with the option of receiving matching contributions to Roth accounts. Prior to SECURE 2.0, all employer contributions were made on a pre-tax basis. Contributions to a Roth retirement plan are made after-tax, after which earnings grow tax free.

Increased Catchup Provisions. Beginning in 2025, individuals ages 60 through 63 will be allowed to make catch up contributions up to $10,000 annually to a workplace plan, and that amount will be indexed to inflation. The current catch-up amount for people over age 50 is $7500. However, there is a condition. If you earn more than $145,000 in the prior calendar year (which will be indexed to inflation), all catch-up contributions will have to be made into a Roth account in after-tax dollars. IRA’s currently have a $1000 catch-up contribution limit for people ages 50 and older. Starting in 2024, that limit will be indexed to inflation, meaning it could increase every year, based on federally determined cost-of-living measurements.

Qualified Charitable Distributions (QCD). Starting in 2023, people who have reached age 70½ may elect a one-time $50,000 distribution to charities through charitable gift annuities, charitable remainder unitrusts, and charitable remainder annuity trusts. The QCD counts toward the year’s RMD.

529 Plan to Roth Conversions7. After 15 years, 529 plan assets can be rolled over to a Roth IRA for the beneficiary, subject to annual Roth contribution limits and an aggregate lifetime limit of $35,000.

Student Loan Debt Relief. Starting next year, employers are allowed to match student loan payments made by their employees. The employer’s match must be directed into a retirement account, but it is an added incentive to sock away funds for retirement.

Disaster Relief. SECURE 2.0 allows penalty-free withdraws up to $22,000 from an IRA or an employer-sponsored plan for federally declared disasters. Later, those withdrawals can be repaid to the retirement account.

Help for Domestic Violence Victims. Victims of abuse may need funds for various reasons, including cash to extricate themselves from a difficult situation. The new legislation has a provision allowing a victim of domestic violence to withdraw the lesser of 50% of their retirement account or $10,000 penalty-free.

Additionally, in March of 2022 Iowa Governor Kim Reynolds signed a tax reform bill which makes distributions from retirement plans exempt from state income tax for Iowans 55 years and older. The exemption from state income tax also applies to Iowans aged 55 and older who do a Roth conversion which provides additional planning opportunities.

These legislative changes help address some of the financial challenges of retirement. Paired with the powerful software we deployed in 2022 which allows us to help clients manage their 401k plans at their current employer, there are potential new planning opportunities available. Let us know if you, or anyone you know, would like to have a personal consultation about retirement planning. Since we do not charge for discovery meetings, the only commitment required is your time.

In closing, we would like to share an analogy which many clients have found helpful. Your financial plan is like sailing across the ocean. Even though we are in the midst of a storm, and we cannot be certain how much longer we will have to endure rough seas, we are also confident that blue skies and calm waters lie ahead. The most effective way to reach your destination is to maintain course.

You must control what you can control. Unfortunately, the stock market and the economy are not within our control. Events overseas are out of our control. But we can control the financial plan. Let us know if you believe changes to your goals, risk tolerance, or financial situation require adjustments.

Sincerely on behalf of the DV Financial team,

Art Dinkin, CFP® & Patrick Owens

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

The Consumer Price Index (CPI) is a measure of inflation compiled by the US Bureau of Labor Studies.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.

The Conference Board Leading Economic Index (LEI) is an American economic leading indicator intended to forecast future economic activity. It is calculated by The Conference Board, a non-governmental organization, which determines the value of the index from the values of ten key variables. These variables have historically turned downward before a recession and upward before an expansion. The per cent change year over year of the LEI is a lagging indicator of the market directions.

1 Yahoo Finance

2 St. Louis Federal Reserve

3 JP Morgan Asset Management

4 U.S. Bureau of Labor Statistics

5 https://www.conference-board.org/us/

6 https://www.wsj.com/articles/big-banks-predict-recession-fed-pivot-in-2023-11672618563

7 Converting a 529 Plan, an employer plan account or Traditional IRA to a Roth IRA is a taxable event. Increased taxable income from the Roth IRA conversion may have several consequences including but not limited to, a need for additional tax withholding or estimated tax payments, the loss of certain tax deductions and credits, and higher taxes on Social Security benefits and higher Medicare premiums. Be sure to consult with a qualified tax advisor before making any decisions regarding your IRA.