Letter to Clients - 2nd Quarter 2023

April 2023

Dear Clients and Friends:

Spring is (finally) here! While I do enjoy each season for different reasons, there is something wonderful about early spring. I enjoy letting the heat of the sun defeat the chill of winter. It is great to start unbundling and spending more time outdoors. The rains of spring wash away the grit and grime which had accumulated, the grass turns green, and flowers begin to blossom. It is a time of change.

At DV Financial, we are also experiencing change. It is an inevitable part of any business. Last month we accepted Patrick’s resignation, and we wish him well. As DV Financial grows and evolves, we continuously strive to have the best possible team on board to serve you and your needs. Let us know whenever we can be of service.

Banking Crisis – 2023 Edition

The financial system has many components. There are financial institutions such as banks and brokerage firms, markets, and exchanges to facilitate the sale and purchase of assets like stocks, bonds, and even credit markets, and participants including investors (both institutional and general public), businesses, and governments. Yet for all these components to work together, the system relies on confidence.

As an example, when you work with a bank you must have confidence that when you want to make a withdrawal, your bank will provide immediate access to your money. But bank vaults are not filled with cash that can be easily repatriated to depositors. Banks generally invest most of their deposits in high quality bonds, treasuries, and loans. If everyone were to show up at the bank at the same time, the bank would not have enough cash to satisfy everyone’s request. When that happens, it is called a “run on the bank” and that is exactly what happened to Silicon Valley Bank (SVB) last month.

The 2008 financial crisis was very different. In 2008, banks were heavily invested in bad real estate loans. When those loans disintegrated, bank assets tumbled, and they lacked sufficient assets to meet depositor demands. However, SVB invested heavily in a portfolio of high-quality longer-term treasuries. From a credit risk perspective, such a portfolio is considered extremely safe and banking regulators had no issues with SVB’s stability. As long as the bonds in that portfolio were held to maturity, there was very little risk. The one mistake SVB made was that they made all their investments in long-term bonds which meant they would have to sell the bonds in the open market if they ever needed liquidity.

SVB specialized in the technology industry. Many of their depositors were technology companies and venture capitalists investing in technology. As traditional sources of funding began to dry up, its customer base began drawing down on their deposits.

SVB was forced to sell some of those very safe long-term assets in their portfolio. Bond prices are inversely linked to interest rates. As interest rates go up, bond prices go down. When SVB sold $21 billion of the bonds in their portfolio to generate cash to meet depositor’s needs, they took a $2 billion loss. To recoup the loss, the bank announced a plan to issue an additional $2.5 billion in stock and SVB stockholders did not respond well to the announcement. Unhappy with such a large loss, they began selling their shares and the stock price tumbled. As the stock price tumbled, depositors lost confidence and began withdrawing money at an increasingly faster rate since a large majority of the bank’s deposits were above the FDIC insurance limit.

It took less than two days for the bank to fail. The plan to raise additional capital was announced on March 8th and regulators were forced to close the bank on March 10th.

Confidence in the banking system was further tested just two days later when Signature Bank, which was heavily involved with cryptocurrencies, was closed on Sunday March 12th. The failures of SVB and Signature were the second and third largest bank failures in US history1. Recognizing the potentially disastrous domino effect which would follow any additional loss of confidence in the US banking system the FDIC announced, before markets opened on Monday, that it would fully guarantee all deposits from both failed banks.

Additionally, the Federal Reserve announced a new lending program2 which allows banks with high quality bonds to post those bonds as collateral (at full value) so there is no need to sell those bonds at a loss to generate cash for depositors. Had this program been in place at the beginning of the month, it may have prevented two bank failures.

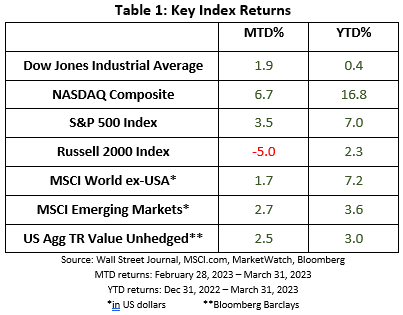

As controversial as it was, the decisions to open the new lending facility paired with a temporary expansion of FDIC coverage helped contain the crisis and restore confidence in the banking system. As the quarter ended, major market indexes reflected that worries had begun to subside.

Impact on the Economy

The financial crisis of 2008 was the effect of subprime lending. The bank failures of March 2023 were the effect of a combination of banks mismanaging the duration of their assets coupled with rapidly rising interest rates. Regulators will investigate and strive for a more thorough understanding of what happened, but the impact of the 2023 banking crisis is already evident and is likely to persist.

The Fed was probably on track to increase the fed funds rate by another 50 basis points to 5.00% to 5.25% at the March meeting. Despite inflation remaining stubbornly high, the Fed opted to defer to banking stability and only raised interest rates by 25 basis points. This was probably a wise decision. If they had not raised rates at all, they may have sent an unintentional signal to the markets that inflation was under control and that interest rates may be at their peak. If they had raised rates more than 25 bps, they increased the impact on the current value of very safe long-term bonds.

However, the Fed is in a difficult position as it needs to address two conflicting goals; fighting inflation with rate hikes which would put additional stress on banks, or concentrating on longer term economic stability. Perhaps banks will begin to tighten lending standards which could slow economic growth and become an ally in the fight against inflation.

While inflation continues to be an issue, at least banking liquidity issues have not spread to other banks. Confidence in the system has been supported and most of the assets of the failed banks have been purchased by other banks. We believe that future rate decisions from the Fed for the remainder of the year will depend more on their perception of economic factors than supporting the banking system.

Confidence in Social Security

On January 31, 1940, the first monthly Social Security check was issued to Ida May Fuller of Ludlow, Vermont for $22.543. Before passing away in 1975, she collected $22,888.92. As the program gets closer to reaching its 100th birthday, it is also getting closer to insolvency. While nearly 75% of Gen Z (born after 1996) do not believe they will receive Social Security benefits4, it is very unlikely that the demise of Social Security will be an all or nothing proposition. Instead, if no further action is taken, a reduction in benefits by about 21% would restore the balance between the inflow of taxes and the outflow of benefits5.

If Congress does nothing, the Social Security trust fund will be exhausted in about 10 years. To quote the late Yogi Berra, “Making predictions is hard. Especially about the future.” Add politics into the equation and predictions become even harder. Simply put, none of us can control what Congress will do to address the Social Security shortfall. However, Social Security has traditionally been considered the “third rail” of politics. No one wants to touch it out of fear of relation from the very active voting block of Social Security recipients.

We believe Social Security will persist, although maybe not the same as it is today. In 1983, Congress increased Social Security’s Full Retirement Age from 65 to 676. When you consider that the average US life expectancy when Social Security was created in in 1935 was less than 657, and that the life expectancy for someone born in the US in 2023 is more than 798, perhaps the benefits will remain unchanged, but Congress will once again increase Full Retirement Age.

Just maintain the correct perspective that Social Security was not designed to replace all your earned income in retirement. It was designed to supplement retirement savings to ensure all Americans a basic standard of living. Yet most people are unaware of the four different types of Social Security benefits.

- Retirement Benefits. This is the most familiar benefit. Under current law, the earliest you may receive your retirement benefit is age 62 although there is a reduction in benefits for initiating benefits prior to Full Retirement Age. However, if you delay benefits beyond Full Retirement Age, your benefits will increase by 8% until they max out at age 70. Calculating the best retirement benefit strategy is a function of longevity. You must choose between receiving more payments of a lesser benefit or fewer payments of a greater benefit. If you have any questions or concerns about the best strategy for you, we can help you calculate the “break even” point where one strategy becomes better than another.

- Social Security Disability. If you meet the minimum work requirements, usually between five and ten years of work experience, you may be eligible for disability benefits. The most difficult aspect to qualifying for disability benefits is meeting Social Security’s definition of disability which requires that you have a severe impairment that is expected to prevent you from doing “substantial” work for at least a year or is expected to result in death.

- Dependent Benefits. If you qualify for Social Security benefits, additional benefits may be available to your spouse or dependents. Minor children may also qualify for dependent benefits depending on the worker’s income.

- Survivor Benefits. In addition to the $255 lump sum benefit to a surviving spouse who was living with a benefit recipient at the time of their death, a spouse is entitled to receive the greater of their own social security benefit or the benefit of their deceased spouse, whichever is greater. Unmarried children under the age of 18 (19 if still in school) may also be eligible for survivor benefits following the loss of a fully insured parent.

The best source of personalized information about your Social Security eligibility and benefits is the Social Security website, www.ssa.gov. At a minimum, you should regularly check your earnings summary as your benefits are a function of your 35 highest earnings years. If your earnings are recorded incorrectly at Social Security, you must request the correction within three years.

If you have any questions about Social Security or any other financial issue, use DV Financial as a resource. We are here to serve you and have specialized software and tools available to model your financial concerns and project outcomes based on a variety of scenarios. Please call us anytime to schedule a consultation.

In closing, I am truly grateful to serve as your financial advisor. Please let me know how and when we may be of service. Sincerely,

Art Dinkin, CFP®

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Not associated with or endorsed by the Social Security Administration or any other government agency.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.

1 https://en.wikipedia.org/wiki/List_of_largest_bank_failures_in_the_United_States

2 https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312a.htm

3 https://www.ssa.gov/history/idapayroll.html

5 https://smartasset.com/retirement/social-security-run-out

7 https://www.ssa.gov/policy/docs/ssb/v49n10/v49n10p24.pdf

8 https://www.macrotrends.net/countries/USA/united-states/life-expectancy