Letter to Clients: 2nd Quarter 2022

April 2022

Dear Clients and Friends:

Everyone has a different perspective when it comes to change. The truth is, change is inevitable and is neither inherently good nor bad. Some change is welcome. For example, we have now been in our new office for six months, and we can no longer imagine how we thrived for so long in the previous location. Conversely, the last few years have been a rollercoaster with twists, turns, and moments when your stomach churns. We continue to live in a world with COVID, inflation affects us all, and there is political unrest in Europe.

Finally, after the usual long winter, it is Spring again - the season of change. Unfortunately, we continue to listen to concerns that the return of warmer weather may not bring with it financial optimism. Let’s start this quarter’s letter with a summary of the current financial conditions, and then we will address a recurring question many clients bring to us – what you should do when you have a financial “windfall”.

Financial Recap

In 2021 we experienced the reopening of the economy, new COVID vaccines, and low interest rates which combined to fuel strong corporate profits and big gains in stocks. By the end of the year, the S&P 500 Index had more than doubled from its late March 2020 bottom[1]. In 449 trading days, the index advanced 113%! This bull market was the best performing compared to the first 449 trading days of the six best performing bull markets since the end of World War II.

But the winds have shifted in 2022.

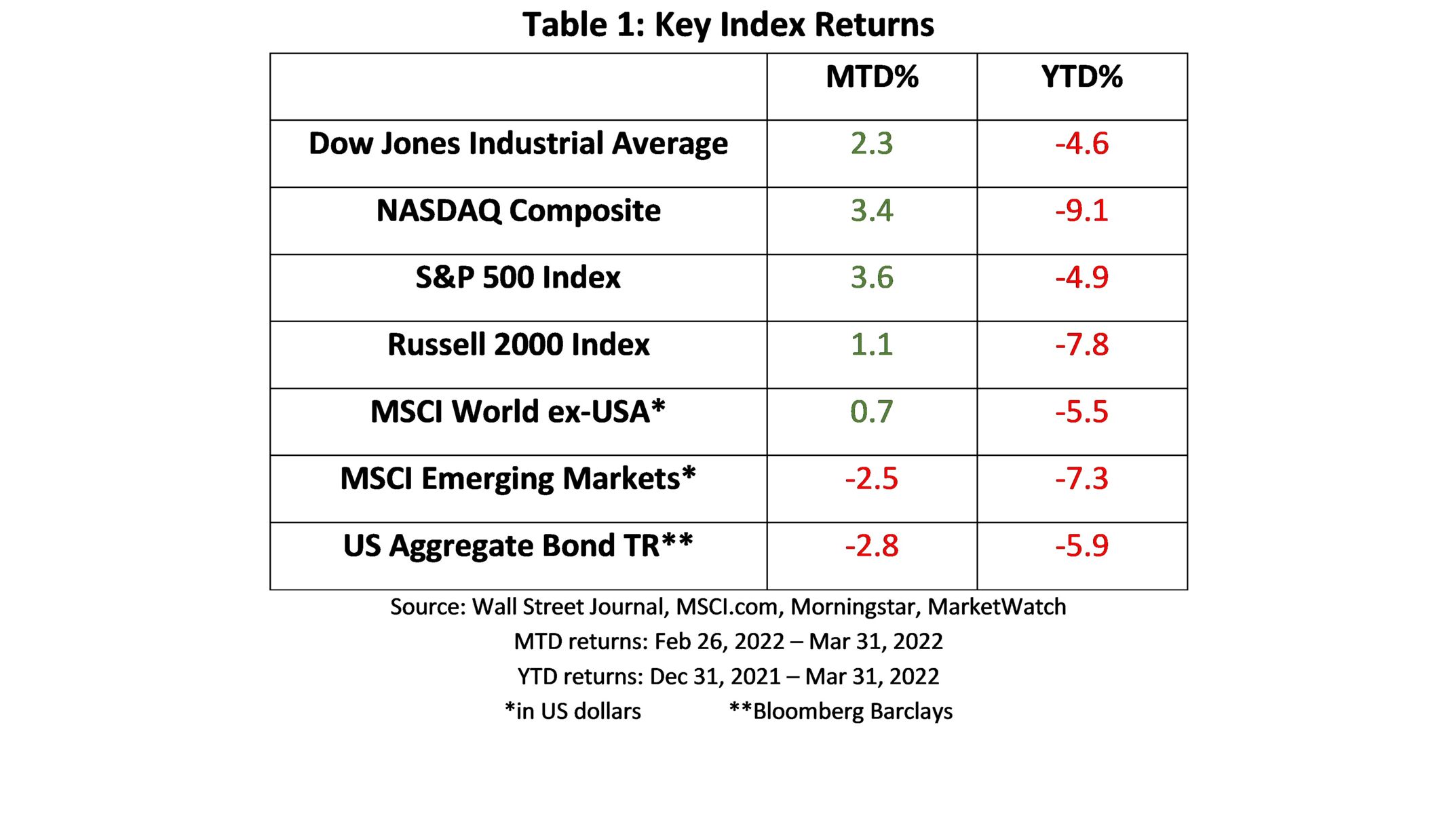

Even though the Federal Reserve is pivoting away from its easy money policy, inflation is on the rise, oil & gas prices are up sharply, and investors are grappling with the fallout of Russia’s invasion of Ukraine. Yet, as the table below illustrates, the major averages have been quite resilient. Corporate profits continue to rise which, when paired with the economic expansion, have cushioned the market downside.

The chart has both red and green. The month of March was reasonably positive, but we are still behind year-to-date. As we have discussed before, stocks never move higher in straight line. Volatility and market corrections are not surprising, they are expected! Still, heightened uncertainty is never comfortable even if losses have been relatively modest.

We do not try to forecast market corrections. Instead, our recommendations are based on belief in the long-term resilience and perseverance of the financial markets and the U.S. Economy. Our approach is supported by nearly a century of “modern” performance and history since the Great Depression. There are no “unexpected” events – we just don’t know when they will occur or how long they will last. Pullbacks are natural and expected. History shows us that they are temporary.

While uncertainty generated by geopolitical events do not cause long-term damage to the major market indexes, they do create short term volatility. The initial news of an event generates heightened uncertainty and motivates short-term traders to pull back. Once investors recognize the crisis will not cripple long-term U.S. economic activity, they incorporate the new situation into their long-term outlook and markets stabilize.

It is fair to say that the situation in Ukraine is not your typical geopolitical event, but so far it seems to be following the historical financial pattern. We would be remiss if we failed to acknowledge the obvious: the atrocities and horrors thrust upon the Ukrainian people are terrible. As humans, we continue to hope for a quick and peaceful resolution before more lives are lost. Unfortunately, few see a cessation of hostilities in the near term.

Investors may be slowly growing accustomed to the daily reports coming from Ukraine. Recently there have been no significant developments that negatively affect investor sentiment, and investors seem to be taking the apparent stalemate in stride. We are becoming comfortably uncomfortable with the war. The situation is being incorporated into investor’s outlooks and there has not been a significant shock to the demand for goods and services in the U.S.

We have seen some supply issues, especially with oil and gas. It is now painful to fill a car up with gasoline. The surge in prices is contributing to overall inflation. According to an estimate from Federal Global Investment Management[2], every penny increase in the price of gasoline drops consumer spending by $1.18 billion per year. If the price of gasoline were to increase by $0.75 for a year, and we have seen shorter term increases of about $1.00, consumer spending would decrease by $90 billion.

Keep in mind that the U.S. Gross Domestic Product is over $24 trillion. A $90 billion reduction in consumer spending would reduce GDP by 0.4%. That is not insignificant, but it is not enough to cause an economic recession without other influencing factors, such as changes to monetary policy.

The Federal Reserve’s commentary has grown increasingly aggressive as it hopes to rein in inflation. At the March meeting, they raised the fed funds rate by one quarter of a percent to 0.25% - 0.50%. Their Summary of Economic Projections suggests we may see a fed funds rate of 1.75% - 2.00% by the end of 2022. Fed Chief Powell has cautioned investors not to discount the possibility of a half-percentage point rate hike (or hikes) at coming meetings.

Rising interest rates change the environment. For savers in interest bearing investments, higher rates mean higher returns. However, if the rate of return is lower than the rate of inflation, interest bearing investments may continue to lose purchasing power.

For equity investors, rising interest rates may be a little more problematic. When interest rates are very low, bonds offer little competition to stocks. As rates and bond yields rise, some investors may be encouraged to look at investments other than equities. If enough investors look to other investments, lower demand for equities may negatively influence stock prices.

From an economic perspective, some worry the Fed may not be able to curb inflation without causing a recession. An extreme perspective is that the U.S. may enter a recession while inflation continues to be an issue creating a poor economic environment known as Stagflation. An economic situation we have not faced in nearly fifty years. In past cycles, rate hikes have been pre-emptive and proactively implemented to control inflation. The Fed successfully engineered “soft landings” in the mid-1980’s and again in the mid-1990’s.

We will continue to monitor the Fed’s reactions to higher inflation and the uncertainties of the current environment. Yet we remain unconcerned with our long-term perspective. We encourage you to remained disciplined in your financial approach and believe you will be rewarded for your resolve. If you have any questions or concerns, know that we are here and available to discuss your situation with you.

Dealing with Financial Windfalls

Not only is spring a time of change, it is also “Tax Season”. Here are some interesting tax facts from the IRS for 2022[3]:

- Through March 25, 2022, the IRS received over 81 million tax returns and processed just under 79 million returns.

- Roughly half of the returns were delivered by tax professionals and the remainder were self-prepared.

- From the 79 million processed returns, the IRS has sent out 58 million refund checks for $188.7 billion. The average refund has been $3,263, which represents a s 12.4% increase over 2021.

For some, getting a tax refund is an annual windfall, but there are other times people receive money they were not expecting. When that happens, they often call us and ask how to be smart with their good fortune. Here are some of the suggestions we typically make:

- Create Stability with an Emergency Fund – It is important to have emergency reserves. Everyone experiences unexpected expenses. It can be home or auto repairs, medical bills, or a disruption to income. When (not if) that happens, having reserves will ease the financial burden and emotional stress. The general rule-of-thumb is to have an emergency reserve of three to six months of expenses readily available. If you do not have a rainy-day fund, this would be the best use of your windfall.

- Eliminate Debt – Perhaps it is a form of urban legend, but there is mythical saying, “The road to poverty is paved by high interest rates.” As we have already discussed, interest rates are on the rise. It can be a struggle to make the payments on high interest rate debt. Pay down or pay off high interest rate credit cards and loans. There are two ways to approach debt. While it may make sense mathematically to focus on the highest interest debt, there is a psychological euphoria you may have by wiping out your smallest balance debts. If that boost encourages you to keep your debt reduction going, we will never tell you that you did it wrong!

- Consider Student Loans – Many people are currently reluctant to eliminate their student loans. Part of the government’s COVID financial stimulus package included a pause on student loan payments. There has been a lot of political discussion about potentially forgiving all student loan debt which has inspired many former students to take a wait-and-see approach. We do not encourage that perspective. Those loans may have helped you pay for college, but now they are a burden to your financial future. Even if the government decided to grant forgiveness for student loans, would that forgiveness become taxable income? Frankly, no one knows how this will turn out. Yet we are confident your financial security would be better (and your financial stress would be lower) without student loans.

- Boost your Retirement – The less reliance you have on Social Security, the more you will enjoy retirement. If you receive the “average” tax refund of $3,263 and put it into your Roth IRA, in 30 years (if you averaged 8% return) your 2022 refund would be worth $32,834! Even if you did not get 8% returns, it is still worth considering. At 6% you would have $18,731 and 10% would bring you $56,937. Returns are not guaranteed but denying a natural inclination for instant gratification can be huge boost to your future. (By the way, if you do put the money in a Roth for 30 years and take it out after age 59.5 the growth would be tax free!)

- Invest in Yourself or Your Family – There are so many options available, just know that we can help you pick an investment which best fits your situation. Maybe you want to start a 529 plan for your kids (or grandkids) education. Maybe there is something you always wanted to do such as learn to play the piano or go back to school. Maybe you want to consider just adding the windfall to your existing portfolio.

- Make a Gift or Charitable Contribution – Perhaps the windfall would mean more to someone else than it does to you. How would your kids react if your windfall became their windfall? What impact could a contribution to your favorite charity have in your community or the world?

- Have Some Fun – Perhaps you deserve a treat. Take that weekend trip, visit a day spa, or make a reservation at an expensive restaurant you’ve always wanted to try. There is nothing wrong with using your windfall for something you will enjoy!

Of course, these are just ideas. If you have unexpected money, be strategic and think long-term. Take some time to consider your options. Acting on impulse and a lack of planning can be costly. It probably does not need to be said again, but we will: We are always here to assist you.

If you have any questions or would like to discuss anything in this newsletter or your money in general, please give our team a call. We are honored and humbled to serve as your financial advisors.

Sincerely on behalf of the DV Financial team,

Art Dinkin, CFP® Patrick Owens

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

The Six Month 95% Probability Range is calculated by Riskalyze from the standard deviation of the portfolio (via covariance matrix), and represents a hypothetical statistical probability, but there is no guarantee any investments would perform within the range. There is a 5% probability of greater losses. The underlying data is updated regularly, and the results may vary with each use and over time.

IMPORTANT: The projections or other information generated by Riskalyze regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. These figures may exclude commissions, sales charges or fees which, if included would have had a negative effect on the annual returns. Investing is subject to risk and loss of principal. There is no assurance or certainty that any investment strategy will be successful in meeting its objectives. Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices do not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.

[1] St. Louis Federal Reserve

[2] Bloomberg

[3] https://www.irs.gov/newsroom/filing-season-statistics-for-week-ending-march-25-2022