Letter to Clients - 1st Quarter 2024

January 2024

Dear Clients and Friends:

Happy New Year! Let’s begin with the hope that 2024 will be your best and most successful year so far.

In 2024 DV Financial is going to start producing videos. The first, scheduled for release in mid-February, will be emailed to all clients. It is a 3-minute video introducing DV Financial to your children, grandchildren, or other heirs. We do not often get to meet your loved ones until we need to, and that is often not the best time to build new relationships. Our hope is that by sending out this video, you can choose to forward it to your children. You decide if you want to encourage them to start building that relationship with us now, and how much information you want to share with them to prepare for the eventual.

When you get the video, I welcome your feedback. We have other videos planned to come out periodically throughout the year. With your input, I hope every video is better than the previous one.

In this letter we will start with discussion about income taxes (everyone’s favorite subject) before we summarize what happened in the markets in 2023 and what we believe lies ahead in 2024.

April showers bring income tax returns, or something like that…

Did you know that our founding fathers did not include income tax as part of the original framework of the United States? In 1909 progressives in Congress attached a provision for an income tax to tariff bill. Hoping to kill the idea for good, conservatives proposed a permanent income tax as constitutional amendment because they did not believe it would ever be ratified by the States. Much to their surprise, the 16th Amendment was ratified in 1913 establishing Congress’ right to impose a federal income tax.

The initial rate was 1% of net income and there were generous exemptions and deductions allowed. Clearly the tax code has changed dramatically over the years, and it will continue to change. Last year, the Internal Revenue Service announced annual inflation adjustments on 63 tax provisions to begin in 20241, including the tax rate schedules. We won’t discuss all 63 changes in this letter, we will just touch on the highlights. For specific tax advice, please check with your tax advisor2.

Tax brackets have changed. In general, each bracket was adjusted upward for inflation. However, we find that most taxpayers do not understand that our tax system is progressive. If you find yourself in a higher tax bracket, that does not mean you are paying a higher tax on your entire income. You pay the higher tax rate only on the income amount in that bracket.

The Standard deduction. In tax year 2024 the standard deduction rises from $27,700 to $29,200 for married filing jointly. For single taxpayers and married filing separately, the standard deduction rises from $13,850 to $14,600. For heads of household, the standard deduction rises from $20,800 to $21,900. If you are over age 65 and file single or head of household, you may take an additional deduction of $1950. Married taxpayers may take an additional deduction of $1,550.

Favorable tax treatment of long-term capital gains. Long term capital gains, such as the profit on the sale of securities held for more than one year, are taxed at a lower rate than short term gains or earned income. This cherished tax break continues in 2024 and the tax brackets have increased for inflation.

Retirement contributions. For IRA’s the contribution limit increases $500 in 2024 to $7000 ($8000 for ages 50+). SEP-IRA limits are increasing from $66,000 to $69,000 but are also subject to a limit of 25% of total compensation. 401k, 403(b), TSP, and most 457 plan limits also increase by $500 in 2024 while SIMPLE IRA participant limits increase to $16,000 ($19,500 for ages 50+).

20% deduction for pass-through businesses. This is a big benefit for small business owners. In 2024 the phase out has been increased to $191,950 for single taxpayers and $383,9000 for joint filers.

Alternative Minimum Tax. Congress enacted the AMT in 1969 following testimony by the Secretary of the Treasury that 155 people with adjusted gross incomes above $200,000 had paid no income tax. Limits were never adjusted for inflation and, in time, threatened tens of millions of Americans with a parallel tax system. In 2017, the Tax Cuts and Jobs Act (TCJA) dramatically increased the thresholds for AMT and allowed for annual indexing. In 2024 the threshold will be $85,700 for singles and $133,300 for married couples filing jointly.

Estate, gift, and generation skipping transfer tax. Taxpayers are exempt from these taxes to the extent that the tax does not exceed the unified credit amount. In 2024, the amount protected by the unified credit will increase from $12,920,000 to $13,6100,00. However, the higher lifetime exemption amounts are set to expire at the end of 2025 and will revert to $5.49 million (adjusted for inflation). Read on…

How long will it last?

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly increased the standard deduction and simplified the filing process by eliminating the need for many taxpayers to itemize. Be aware that unless it is extended, at the end of 2025:

- Individual tax rates will revert to their 2017 levels,

- The standard deduction will be cut roughly in half, the personal exemption will return, and the child tax credit will be reduced,

- The estate tax exemption will be reduced,

- The 20% tax deduction for pass-through businesses will disappear, and

- The cap of $10,000 on state and local income taxes, which is not adjusted for inflation, will disappear.

2023: The blockbuster year that was not supposed to happen3

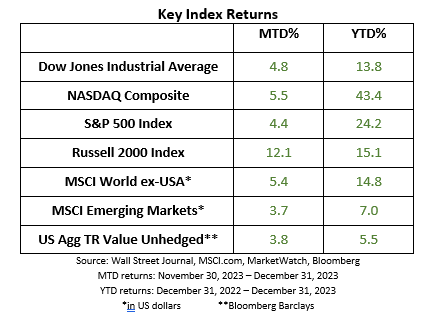

Last year, on average, strategist predicted a 2% decline in the S&P 500 Index for 20234. As it turns out, 2023 turned out to be a banner year surprising nearly everyone except Yogi Berra who is reputed to have said “It is difficult to make predictions, especially about the future.”

Keeping with the sports metaphor, the score in 2023 was Analysts 0, Disciplined Investors 1. In retrospect, we believe three major themes played out last year.

First, 2023 began with a pervasive opinion that a recession was inevitable. To be fair, economists always find it difficult to identify turning points in economic cycles. According to a recent paper published in the Journal of Economic Perspectives5, In the past 60 years the Fed has tried multiple times to achieve a “soft landing” (slowing the economy down without causing a recession) but has only been successful once (1994-1995). Knowing that, believing the Fed would engineer a successful soft landing in 2023 should have been a long shot. Except that, at least so far, we have managed to avoid a recession. It is still too early to proclaim victory. Perhaps a recession is still in our future, but we did manage to avoid it in 2023.

Another major theme of 2023 was interest rates. As inflation began to slow, the Fed eased off raising interest rates. In 2022 the Fed raised interest rates by 4.25%6 which was the fastest pace of rate hikes since 1980. In 2023 the pace slowed to just 1% which reduced stiff headwinds for stocks. By December 2023 the Federal Reserve had effectively shifted its stance and began discussing the potential for interest rate cuts in 2024. This shift in policy fueled the market’s advance into the end of the year. The S&P 500 ended 2023 just shy of it’s all-time high set in early 2022, but the Dow Jones Industrial Average (DJIA) eclipsed it’s all-time high in December 2023.

Finally, the last major theme of 2023 has to be the emergence of Artificial Intelligence. Formerly science fiction, today advanced AI technology is affordable and easy to access from any internet capable device. The technology is in its infancy but the potential is enormous. Large investments are being made into technology that could yield big dividends someday. This optimism and excitement surrounding these new opportunities fueled the tech-heavy NASDAQ Composite to post a gain of over 40% in 2023. The same winners on the NASDAQ powered the gains in the S&P 500.

What lies ahead in 2024?

It doesn’t matter if Yogi Berra actually said those words or not, he is right. Don’t get caught up in making predictions. The only prediction we believe for 2024 would be to expect the unexpected.

We will be watching inflation and interest rates carefully. If inflation continues to slow down, it will take pressure off the Federal Reserve and interest rate cuts may come sooner than anticipated. Investors are currently betting on the Fed achieving a soft landing. As we already pointed out, this isn’t an easy objective. If economic growth slows too much, stalls, or a recession ensues, any positive benefit of lower interest rates could be overshadowed by weaker corporate profits and stock prices could suffer.

Having a diversified portfolio has traditionally been one way to prosper despite market volatility7. While it does not make your portfolio immune from market pullbacks, it has historically proven to dampen the major market swings and can help reduce overall risk. Although volatility is unsettling, it is important to recognize that is often temporary. When Silicon Valley Bank failed in early 2023 and Hamas attacked Israel later in the year, did anyone think 2023 would turn out to be a good year?

Get Comfortable

When we meet new prospective clients, we are often asked what makes us different. The truth is there are a lot of great, well qualified, financial planners and many great firms. We like to believe that we can be considered one of them. So that does not set us apart.

We believe many people find money to be an uncomfortable topic, and our goal is to make people comfortable with their money. We provide a safe and judgement free process for you to get comfortable and ask questions you are not comfortable asking elsewhere. We can make complex financial decisions easier to make because we will make sure you understand.

Let us know if you or anyone you know has any questions or wants to explore a financial plan in greater detail. We are here to serve you and are honored for the opportunity.

Sincerely,

Art Dinkin, CFP®

This newsletter contains general information that may not be suitable for everyone. The information contained herein should not be construed as personalized investment advice. Past performance is no guarantee of future results. There is no guarantee that the views and opinions expressed in this newsletter will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices does not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 actively traded “blue chip” stocks, primarily industrials, but includes financials and other service-oriented companies. The components, which change from time to time, represent between 15% and 20% of the market value of NYSE stocks.

The Nasdaq Composite Index is a market-capitalization weighted index of more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

The MSCI All Country World Index ex USA Investable Market Index (IMI) captures large, mid and small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 23 Emerging Markets (EM) countries*. With 6,062 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

Barclays Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities of at least one year.

1 https://www.irs.gov/irb/2023-48_IRB#REV-PROC-2023-34

2 DV Financial does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

3 This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

4 Bloomberg

5 https://www.aeaweb.org/articles?id=10.1257/jep.37.1.101

6 St.Louis Federal Reserve

7 Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.