Letter to Clients - 3rd Quarter 2024

July 2024

Dear Clients and Friends:

Hard to believe we have already passed the halfway point for 2024. Maybe it is just anomalies of my memories, but I think this has been a pleasant summer. Even though we have had some high heat indexes, we have also had enough rain that lawns have stayed green and colorful flowers highlight the landscape.

July also marks the beginning of sweet corn season. Nothing says “Iowa” better than summer dinner of corn on the cob and watermelon.

In our last letter we announced that our first video would be released soon. Now we have released several and more are on the way. You can find our videos in the blog section of our website, www.dvfin.com, on our Facebook and LinkedIn pages, and we also send them via email to you. Please feel free to share them with other people you may know who may enjoy them, and we also welcome your opinions about what we are doing well and what we could be doing better.

As of June 2024, due to regulatory changes, we are no longer voting proxies on behalf of clients. Unfortunately, even though our firm’s policy has changed, we need every client who has an account at Schwab to complete a simple form letting Schwab know that we will no longer be voting proxies on your behalf. Ihla is sending out the form via DocuSign. She does a few more every day. Please be on the lookout for it, but if you have any questions or concerns, please do not hesitate to give me a call.

Is Artificial Intelligence the Tip of the Iceberg?

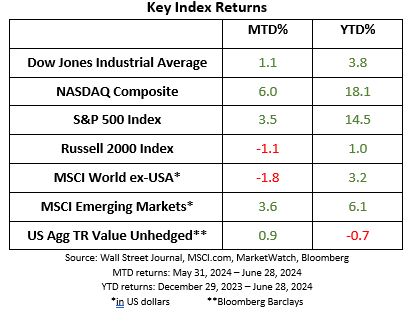

I am told that only about 10% of an iceberg is visible while the remaining 90% is submerged underwater. Perhaps that could also be a metaphor to describe the market environment in mid-2024? The S&P 500 and Nasdaq notched several all-time highs in June, building on an impressive advance this year.

What is behind this impressive market Year-To-Date?

The AI revolution is powering significant gains in the technology sector providing significant tailwinds for the tech heavy NASDAQ as well as the S&P 500. Look no further than AI chip maker Nvidia (NVDA), which briefly became the largest publicly traded company in the world last month.

Both the NASDAQ and S&P 500 are market cap weighted. This means that the larger the company is in terms of its market value, the more influence it has on the index. The market capitalization of the entire S&P 500 is approximately $46 trillion1. The three largest stocks in the S&P 500 themselves have a market capitalization over $9 trillion. Fortune pointed out that Nvidia alone accounts for more than a third of the S&P 500’s gains this year2. A June 21, 2024 article in the Wall Street Journal cites that Nvidia accounts for 44% of the rise in the S&P 500 since the end of 2021.3 If you recalculate the S&P 500 using just the 10 largest companies (instead of all 500), that index rose nearly 29% in the first half of the year.4

Is it just the largest companies which are doing well in 2024?

An interesting way to answer that question would be to compare the S&P 500 index with the S&P 500 Equal Weight index. As the name implies, both indexes are comprised of the same stocks, but in the equal weight index each stock makes the same contribution to the index calculation.

The S&P Equal Weight index was up a respectable, but modest, 3.25% through the first two quarters of 2024. Notably, in the second quarter, the equal weight index was down 3.1% versus an advance of nearly 4% for the S&P 500 market cap weighted index.

Our perspective is not uncommon. On April 6th an article appeared in Barrons “The Stock Market Rally Is Being Driven by a Few Big Stocks”5 and on June 6th the Wall Street Journal concurred “This Rally Is All About a Few Star Stocks – and Some Investors Are Worried.”6

Of course, it is not just AI which has fueled this year’s advance. Corporate profits have exceeded expectations, job growth is solid, and the economy seems to be expanding while the soft-landing scenario still appears to be in place.

We continue to believe that economic fundamentals – economic growth and corporate profits – have the greatest influence on market performance in the near and medium term. If a recession materializes later in the year, it would be reasonable to expect volatility to return. However, a gentle economic slowdown that supports earnings would be expected to create a more favorable environment for investors.

Over a longer period, optimists argue that investors are still underestimating the economic impact of the AI revolution. The upbeat scenario argues that technology, boosted by AI, will drive productivity fueling economic growth just as millennials are entering their prime spending years.

We have no special insight into the future. We acknowledge that visibility is limited, and we never dismiss the possibility of a market pullback. However, the market’s long term track record continues to provide a compelling reason why stocks should be a significant allocation in every diversified investment portfolio.

What Is Your Estate Plan?

A recent survey revealed that only one third of Americans have a will or a plan to distribute their assets after they die, and that 40% don’t think they have enough assets to need a will.7 This supported the findings of an earlier survey which showed that 9% of Americans had an out of date will while 63% had no plan in place.8

There are many examples of famous people dying without written plans including Aretha Franklin, Prince, Michael Jackson, Bob Marley, Jimi Hendrix, Sonny Bono, Kurt Cobain, and Amy Winehouse. But this is not just a problem for young rockstars. Even Abraham Lincoln, who was a lawyer, didn’t have a will!

Perhaps the reason so many people do not have a written plan in place is because they think that Estate Planning is only for the famous and wealthy, but they are wrong. Dying intestate – without a will – has consequences no matter where you live. Without your direction, it is your State of residence which decides who will receive assets from your estate, and how much they will get. This can become especially painful if there are unmarried partners, stepchildren, or even a parent’s own child who may be deprived of an inheritance.

Without a plan, your loved ones will be forced to guess your intentions against a backdrop of an already difficult situation. Even if potential heirs are on good terms, money can sometimes cause divisions.

When you die, your estate will pass through probate which is the legal process for reviewing the assets of a deceased person and determining who inherits which assets. If you have a will, it ensures that the executor of your estate will honor your wishes.

However, there are ways to bypass the probate process because probate can be expense, time consuming, and becomes public record. The title on an asset can bypass probate when things are declared to be Joint Tenants With Rights of Survivorship (JTWORS) or if there is a Transfer on Death (TOD) designation. Accounts with named beneficiaries such as life insurance or retirement accounts also bypass probate. With some legal assistance, it may be a good idea to incorporate a trust which can do many of the same things a will can do, but without the assistance of the probate process.

A holistic financial plan includes a plan of succession. If you have recently crafted an estate plan or have updated your will, a hearty congratulations goes out to you. If not, let’s get started.

We recognize that estate planning is a personal process. In some cases, you may feel overwhelmed, especially if you have a large family, a blended family, or a family that has endured separations and divorce.

Our objective is to is to initiate a dialogue, assist you in developing a plan, or motivate you to update an existing plan if necessary. Use DV Financial as a resource to address any questions you may have. Failure to act puts your legacy at risk. Our mission is to help you get comfortable with your money.

Get Comfortable

At DV Financial, we have over 35 years of experience helping people make all kinds of decisions, including developing and reviewing estate plans. We can help you review your accounts to make sure beneficiary designations and TOD’s are up to date, and can help you understand any estate tax implications of your plan.

While we are not attorneys and do not provide legal services, we can work with you and your attorney to design legal documents to ensure your plans are enacted. If you don’t have an attorney, we can refer to several we have worked with in the past.

As always, we are honored to serve as your financial advisor. We appreciate the trust you have placed in us. We hope you have found this newsletter to be informative. If you wish to discuss anything from this newsletter or any other matter, please let us know so we can schedule time to address your concerns.

Sincerely,

Art Dinkin, CFP®

1 https://www.slickcharts.com/sp500/marketcap

4 https://www.spglobal.com/spdji/en/indices/equity/sp-500-top-10-index/#overview

5 https://www.barrons.com/articles/stock-market-rally-apple-tech-9bbb6f11

7 https://www.caring.com/caregivers/estate-planning/wills-survey/

8 https://www.uslegalwills.com/blog/americans-without-wills/