Letter to Clients - 4th Quarter 2024

October 2024

Dear Clients and Friends:

If you stop in or call, you may see a new face or hear a new voice. Kaylin Stevenson joined the DV Financial team in August. Kaylin brings a wealth of knowledge and a passion for financial planning to her role. She holds a bachelor’s degree in Health Sciences and a master’s degree in Health Informatics and Analytics from Drake University, where she graduated in 2023.

After completing her education, Kaylin spent a year working as an independent health insurance agent. It was during this time that she discovered her enthusiasm for helping people manage their financial stress and plan for their future. This realization inspired her to transition into a role where she could support the team behind the scenes, ensuring that operations run smoothly and efficiently.

Outside of work, Kaylin lives in West Des Moines with her husband, Isaac, and their adorable pets: two cats, Paisley and Charlie, and a lively beagle puppy named Daisy. Although having a beagle is not a requirement to join the DV Financial team, Paisley, our Chief Beagle Officer, might have a different opinion on the matter.

One of Kaylin’s first projects is to review every client file to determine if there are open administrative issues. For example, when we changed our proxy voting policy in June, we had to get forms signed on hundreds of accounts to reflect the change. Most of these have been done, but we still have a few accounts waiting on client signatures. We are also reaching out to clients who have inactive accounts to see if they should be closed.

Please join me in welcoming Kaylin to our office.

In this client letter, we are going to first examine the markets and then, in honor of Cybersecurity Awareness Month, some tips to help you stay safe in the digital world.

Fed Cuts Rates

Last month, the Federal Reserve announced its first rate cut since early 2020 lopping 50 basis points (one basis point or bp is one one-hundredth of a percent or 0.01% therefore 50 bps is the same as 0.50% or one-half of one percent) off the fed funds rate, bringing the rate down to 4.75% - 5.00%. This officially ends the most aggressive rate hike cycle in more than 40 years.

Some investors were concerned that the 50 bps move was a signal that Fed officials are worried about the economy. After all, the unemployment rate is up from its cyclical low and job growth has slowed. However, most economic indicators suggest the economy is continuing to expand and remarks by Fed Chief Powell soothed investors’ concerns. For now, investors are taking Powell at his word that an economic soft landing is still in play.

Why did the Fed decide on a more aggressive 50 bps reduction rather than a more modest 25 bps? Typically the Fed prefers more measured approaches when it enacts policy changes unless policymakers are reacting to unwanted shifts in economic activity, such as soaring inflation. During his press conference, Powell emphasized that the “economy is in good shape” but he implied that the larger rate cut is a pre-emptive move. Essentially, the 50 bps rate cut is insurance against an economic slowdown. “We’re not waiting for (rising layoffs) because there is thinking that the time to support the labor market is when it’s strong and not when we begin to see layoffs”, he said.

It is a balancing act. If the Fed were to delay rate cuts or reduce rates too slowly, there is a very real risk of the economy slowing enough to be in recession. But if rates are reduced too quickly, it can overstimulate the economy and cause inflation. A year from now, the difference between a 25 bps and a 50 bps rate cut will be insignificant. But today, it is big news.

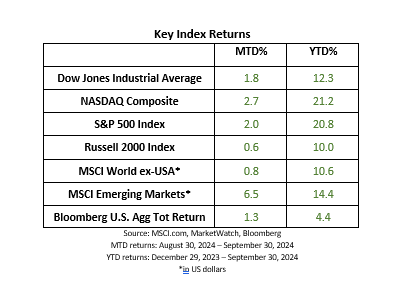

Investors Respond. Market Update

Growing profits, moderating inflation, falling interest rates, and modest economic growth have traditionally been strong tailwinds for equities. During September, the Dow and the S&P 500 reached record highs. Although the Fed initially misjudges the emergence of inflation, it has regained some credibility as inflation has slowed down without a recession. Accordingly, market performance this year has been strong.

Robust market performance can lead to euphoria and can encourage too much risk-taking. We caution against that. Being overweight in stocks may support returns, but unexpected volatility from any number of sources can spark shorter-term declines which may exceed your comfort level.

Our philosophy is simple, proven, and unchanged. We believe the markets are very predictable in the long term, and quite unpredictable in the short term. Therefore, we build and invest in diversified portfolios designed to match your risk tolerance with your financial goals and needs.

While others react to news (such as upcoming election results?), we continue to maintain a disciplined course and act with purpose and conviction.

It is only natural to want to be reflexive as new information becomes available. If you, or anyone you know, gets anxious about the markets and wants to explore how your financial future will be affected, know that we are here for you. We are happy to discuss your situation and, if changes are appropriate, we can apply the proper adjustments.

Cybersecurity Awareness

The FBI’s Internet Crime Complaint Center (IC3)[1] receives thousands of complaints every day reporting a wide array of scams, and they are becoming increasingly sophisticated. In 2023, the FBI’s Elder Fraud report stated that losses reported to the IC3 by people over age 60 topped $3.4 billion, an increase of 11% in reported losses from 2022. The average dollar loss per victim was $33,915. While complaints filed with the IC3 by older victims rose 14% in 2023, many believe the statistics are not representative of the reality as many victims are too embarrassed to make a report or don’t believe making the report will result in recovering their loss.

Older citizens are particularly vulnerable because social norms have changed. For example, many of us were raised in an era of telephone communication, without caller ID, where it wasn’t uncommon to receive a call from a stranger who misdialed. A quick “You must have the wrong number” followed by an “Oh, I’m sorry” quickly ended the exchange in less than 30 seconds.

Today, scammers call or send a text message in hopes that the recipient will respond and take the bait. According to the FTC, scammers use such innocent seeming openings to engage in friendly conversation in hopes of developing first a familiarity and then later, your trust. Once they have your trust, they’ll offer advice on investing, cryptocurrency, or some other “opportunity”. But it is a scam. If you follow their guidance, it will turn into a costly lesson.

In other instances, the scammer may share of photo of “themselves” from a unique location or doing something interesting, but the photo is a digital “trojan horse” which is embedded with malware (malicious software). Once you download the picture, you have opened the door to hackers who can gain access to your phone, keystrokes (including passwords), financial information, and other sensitive data.

Even if you quickly break off the conversation, your response indicates that your phone number is “live”, and scammers are likely to increase the frequency of fraudulent and annoying attacks. If you see such a message, it is best not to open it. Just hit “block and report SPAM”.

It is best not to answer calls from numbers you do not recognize. If it is important, the caller can leave a voicemail. Never call an unknown number back, even if it looks like a local number. In what is called the “one ring scam”, fraudsters make their international calls appear to be US phone numbers to trick you into returning the call. Once you do, they will do their best to keep you on the line assessing per minute charges which will be revealed in a huge expense on your next phone bill.

Another common scam is known as impersonation. The target receives a text message that claims to be from Netflix or PayPal alleging something is wrong with your account and provides a link for you to re-establish service. Or the message claims to be from FedEx or UPS to inform you that a package is being held at a warehouse because they need your address. Again, the scammers want you to click on the link to arrange delivery. All these links are nefarious and troublesome.

The ”grandparent” scam is particularly emotional, which is the scammers goal. In this situation, the target gets a call from a scammer posing as the victim’s grandchild purportedly in jail or in need of dire medical attention. Artificial intelligence can convincingly duplicate the grandchild’s voice. But the bottom line is money is needed, quickly. The scammers will try to convince you of the need to keep this a secret so that verifying the truth is difficult.

The “romance” scam preys on victims of all ages. According to the FBI[2], criminals use a fake online identity to gain a victim’s affection and trust. The scammer then uses this illusion of a romantic relationship to manipulate and steal from the victim. In these scams, there is usually talk about meeting in person, but it doesn’t happen because the other person doesn’t really exist. Eventually, when the victim is completely smitten and vulnerable, the scammer asks for money. In extreme cases which have been reported, some victims have willingly given hundreds of thousands of dollars to the criminals.

The bottom line: Never send money to anyone you’ve communicated with only online or by phone.

Phishing is a hacking technique where scammers use emails or text messages designed to steal passwords, account numbers, and social security numbers. Scammers launch billions of phishing attacks every day[3] and they are successful more often than you would think. Designed to look official, here are some signs which could help you spot fraudulent messages:

-

The email has a generic greeting and does not address you by name.

-

It is from an unknown email address that does not reflect the purported senders’ proper URL.

-

The email says your account is on hold due to a billing problem.

-

The email requires you to click on a link to update your account or payment details.

Be careful! With the advent of artificial intelligence, phishing emails are getting better at looking legitimate and are often devoid of typos and misspelled words, which are also signs of a scam. If in doubt, call the company but don’t use a phone number provided in the email. Use a phone number on a statement or look up the phone number directly from the company’s website.

What Should You Do?

The best way to protect yourself from Cyber Crime is to be defensive.

-

Use a unique password for every account. Make sure your passwords are long and complex using a variety of letters, numbers, and symbols.

-

Protect your computer and phone with well-known security software which automatically updates.

-

Protect your accounts using multi-factor authentication which requires additional credentials to access your account such as a one-time code sent to you by text, email, or through an authenticator app. But if you ever get a phone call from someone asking for your PIN or passcode, HANG UP! No one from your bank, financial institution, or legitimate company will ever call you and ask for this information.

-

Limit the amount of personal information you share on social media. It’s best not to include family information and personal information which can be “socially engineered” into figuring out the answers to your security questions or may give hints to your passwords.

-

Don’t let your guard down and let common sense be your guide.

If you make a mistake and provide information you regret, remember that we are all human and the reason all these scams exist is because it is easy to become a victim. Don’t beat yourself up. Here are some things you can do:

-

Change your passwords immediately.

-

Check your financial statements and call any financial institution where you think your account may have been compromised.

-

Make a report to IC3.

-

Contact the three major credit bureaus who can issue a fraud alert making it more difficult for someone to use your credit. You may even want to consider “freezing” your credit.

Not only is identity theft costly from a financial perspective, but there is also a cost of time, frustration, and anxiety in the aftermath. It is so impactful that it is recognized by the National Institute of Health[4]. While we are not IT or Cyber experts, we are happy to take calls from clients who question the validity of emails and want to know if they were sent by us. We will do whatever we can to keep our clients safe.

Get Comfortable

As always, we are honored to serve as your financial advisor. We appreciate the trust you have placed in us. We hope you have found this newsletter to be informative. If you wish to discuss anything from this newsletter or any other matter, please let us know so we can schedule time to address your concerns.

Sincerely,

Art Dinkin, CFP®

[2] https://www.fbi.gov/how-we-can-help-you/scams-and-safety/common-frauds-and-scams/romance-scams